World

Top 5 Indian CEOs in the World

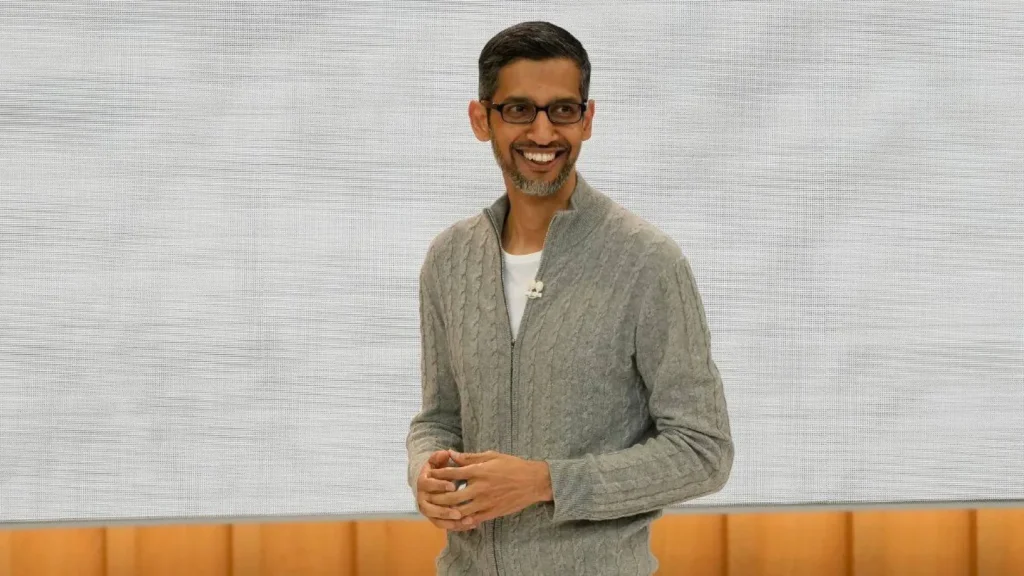

Sundar Pichai – CEO of Google and Alphabet

- Pichai Sundararajan who is known as Sundar Pichai was born in Madras (Chennai), Tamil Nadu.

- He began his career as a materials engineer. He is also an IITian who earned his degree in metallurgical engineering from IIT Kharagpur.

- Pichai started his innings at Google leading the product management and innovation efforts for a suite of Google’s client software products.

Pichai was made the CEO of Google in 2015 and later on, he was given the charge as CEO of Alphabet Inc, the holding company of Google in December 2019.

Satya Nadella – CEO of Microsoft

- He was Born on 19 August 1967 in Hyderabad which currently is in today’s Telangana.

- Nadella earned his bachelor’s degree in electrical engineering from Manipal Institute of Technology, Karnataka.

- He moved to the United States in 1990 for further studies. He joined as a member of the technical staff of Sun Microsystems prior to joining Microsoft in 1992.

Nadella was appointed as the CEO of Microsoft in February 2014.

- Nadella has also co-authored his memoir named ‘Hit Refresh‘ with Greg Shaw, and Jill Tracie Nichols.

Arvind Krishna – CEO of IBM

- He was born in 1962 in West Godavari, Andhra Pradesh.

- Arvind Krishna earned his B. Tech degree in electrical engineering from the Indian Institute of Technology, Kanpur.

- After joining Thomas J. Watson Research Center of IBM in 1990 followed by elevations to different levels of the company.

Krishna was appointed as the CEO in 2020.

Shantanu Narayen – CEO of Adobe Systems

- He was born on 27 May 1963 in India’s Hyderabad, Telangana.

- Shantanu Narayen went to the United States for further studies after pursuing his bachelor’s degree in electronics and communication engineering from College of Engineering, Osmania University Hyderabad.

- He started working with a startup named Measurex Automation Systems in 1986 and then worked with Apple from 1989 to 1995.

Narayen joined Adobe in 1998 as senior vice-president of worldwide product development and was promoted to the post of COO (Chief Operating Officer) in 2005 and then as CEO in 2007.

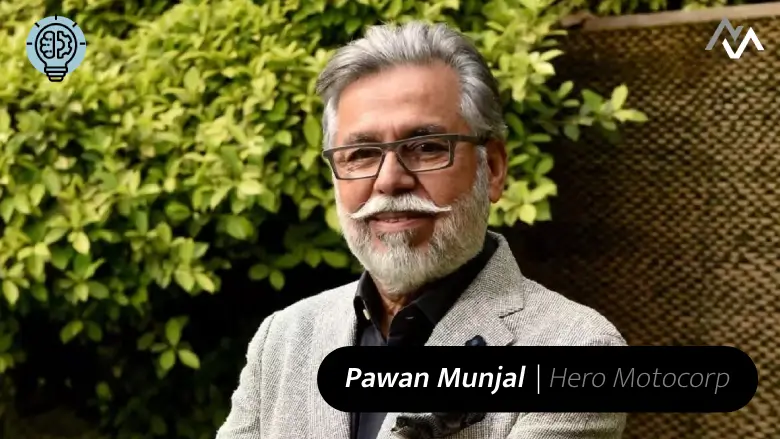

Pawan Munjal – CEO of Hero Motocorp

- Pawan Munjal was born on October 29, 1954, in Ludhiana, Punjab.

- Munjal holds a bachelor’s degree in mechanical engineering from the National Institute of Technology, Kurukshetra (Haryana). He belongs to the family that promotes the Hero Group.

- Currently serving as the Chairman, Managing Director, and CEO of Hero Motocorp, Pawan Munjal started his innings at the company as Director.

Munjal was ranked 49th in the 50 Most Powerful People of 2017 list of India Today Magazine.

Disclaimer All images Source By Google Images.